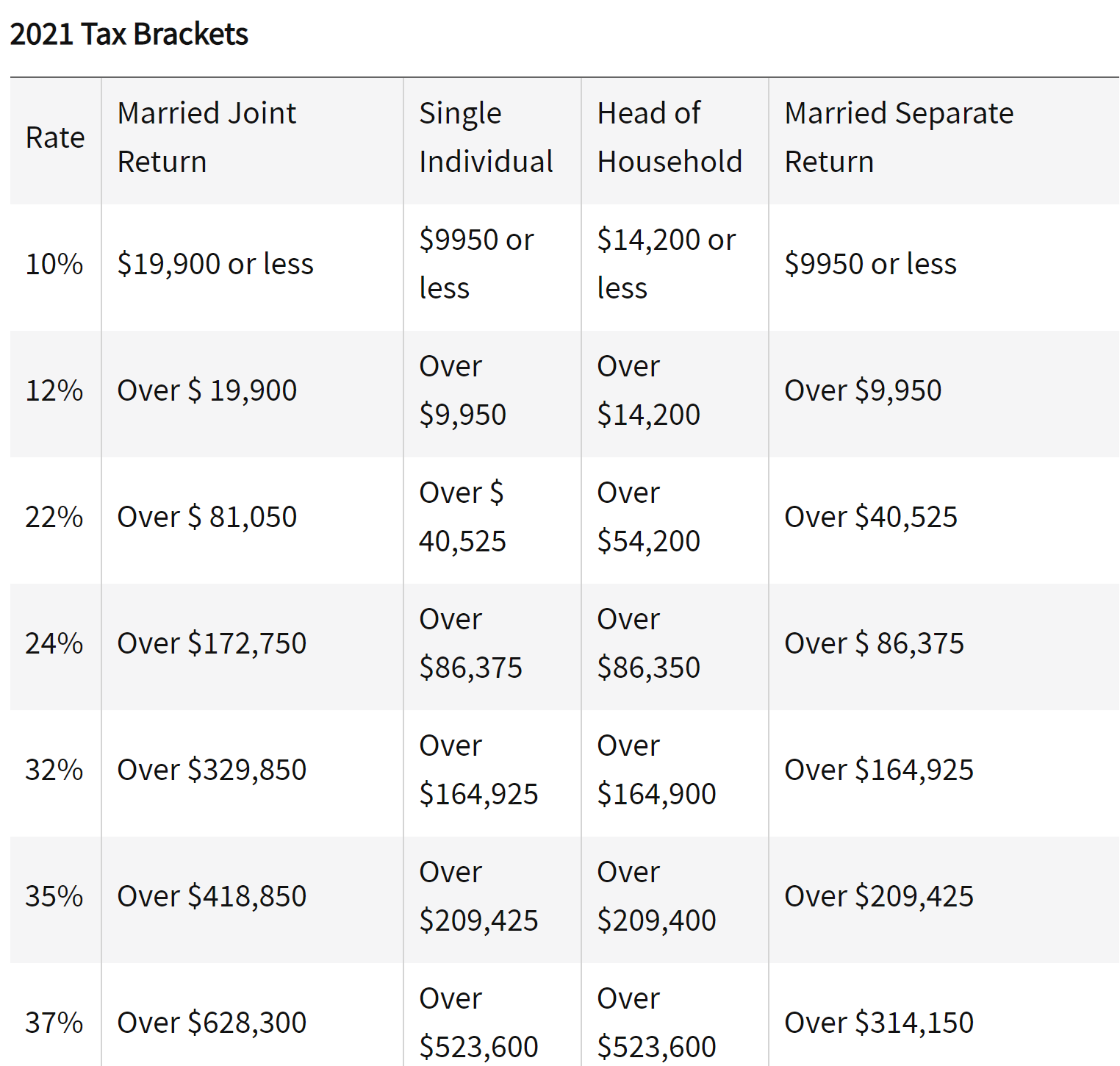

Each year the IRS adjusts tax brackets and other tax provisions to account for inflation. Your tax bracket is based on your income and your filing status (single, married filing jointly, married filing separately, head of household). In tax-speak, this is called the marginal tax rate.

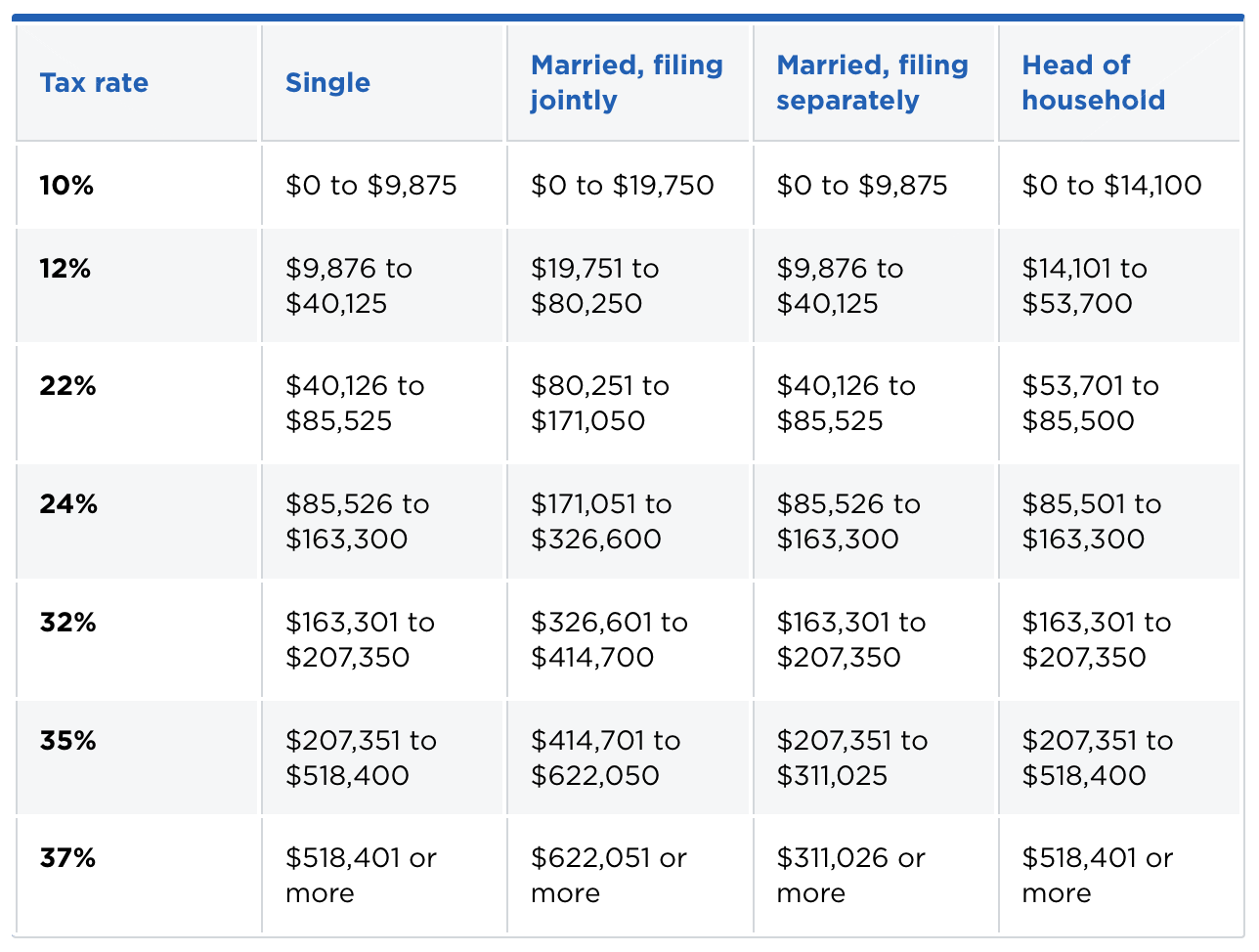

What that really means is that they pay 22% on the portion of their income subject to the highest tax rate - just the dollars that fall within that particular bracket - not every dollar they earn. When someone says they are in the 22% tax bracket, it’s a bit of a misnomer. (Apologies to gabillionaires for the snark.) The dollars you earn above that - and up to a specific amount - are taxed at the next higher tax rate (12%), and so on it goes until you earn so much that you somehow don’t have to pay taxes at all. The first chunk of income you earn is taxed at the lowest tax rate (10%). simply means not all of your income is taxed at the same rate. The “progressive tax system” we have in the U.S. In 2022 the 22% tax bracket shifted slightly higher to between $83,551 and $178,150.īut before we get into the details of the tax brackets, let’s back up and untangle progressive tax math.įREE TAX FILING WITH CASH APP TAXES: Click here to start filing with Cash App Taxes. For example, in 2021 the income bracket subject to the 22% tax rate for a married couple filing jointly was between $81,050 and $172,750. What typically changes is the range of income that is taxed at each of the seven rates. States have their own rules on how they tax income, if they tax income at all. Just like in previous years, there are seven federal tax brackets for 2022: 10%, 12%, 22%, 24%, 32%, 35% and 37%. New York State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 16,450.If you are one of the millions of people who haven’t filed your income taxes just yet, don’t panic! Here’s a handy guide for the 2022 tax brackets you can use when prepping your 2022 taxes that are due by April 18, 2023. New York State Married Filing Jointly Filer Tax Rates, Thresholds and Settings New York State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction New York State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 8,200.00 New York State Single Filer Tax Rates, Thresholds and Settings New York State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction If you would like additional elements added to our tools, please contact us. The New York tax tables here contain the various elements that are used in the New York Tax Calculators, New York Salary Calculators and New York Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

Single tax brackets 2021 full#

The New York State Tax Tables below are a snapshot of the tax rates and thresholds in New York, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the New York Department of Revenue website. This page contains references to specific New York tax tables, allowances and thresholds with links to supporting New York tax calculators and New York Salary calculator tools. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. The New York Department of Revenue is responsible for publishing the latest New York State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in New York. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The New York State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New York State Tax Calculator.

0 kommentar(er)

0 kommentar(er)